|

| State & Local Education News |

In the fight against sexual assault, this school district is teaching about consent

Washington Post

June 21, 2016

The educational video opens with a sober warning: Those who rape and sexually assault are not always predators hiding in the shadows; they sometimes are those closest to you.

“My idea of rape was someone snatching me up in an alley, a dark alley, a stranger, not someone that I date, not someone I trust,” a young woman and survivor of sexual assault says as the video — “Defining Sexual Assault” — begins to walk students through the challenging subject.

This might be the kind of lesson you’d expect on a college campus as the nation continues to respond to the deep and growing concern about sexual assault. But in Fairfax County, Va., one of the nation’s largest public school districts, the video is a proposed part of a new sexual education curriculum designed to teach teens about consent and assault before they graduate from high school.

K–12 Maker Initiative Captures the Spotlight at the National Maker Faire

Ed Tech-Focus on K-12

June 20, 2016

Tinkerers, makers and inventors from across the country descended on Washington, D.C., for the second annual National Maker Faire this weekend.

The two-day event, held at the University of the District of Columbia, came as part of the White House’s National Week of Making celebration, which runs from June 17 to 23.

Faire attendees watched demonstrations from makers of all ages, tried their hands at tinkering during interactive workshops, and listened to presentations from celebrities, entrepreneurs, winners of the White House’s Champions of Change awards and education thought leaders.

One such speaker included Pam Moran, superintendent of Albemarle County Public Schools in Charlottesville, Va., who spoke Sunday about her experiences with the Maker movement in a talk titled #Getting2Yes: Making Makers in Albemarle Schools.

Grey W. Ritchie, early childhood education advocate, dies at 93

Richmond Times-Dispatch

June 25, 2016

Grey W. Ritchie, an advocate of early childhood education once known as “Ms. Kindergarten,” has died. She was 93.

“Grey Ritchie’s legacy can be found in the commonwealth’s 1,156 elementary schools, where — due in large measure to her advocacy for early childhood education — there are kindergarten classrooms and children who enter the first grade prepared to learn,” said Steven R. Staples, Virginia’s superintendent of public instruction, in a statement this week.

Mrs. Ritchie, who died Monday, had spent the past 10 years living in Richmond. Before that, she had lived in Chesterfield County.

Virginia Tech partnering to improve higher education in Norfolk

CBS 3 (WTKR)

June 24, 2016

A new college partnership is starting at four Norfolk schools in the fall to help increase student access to higher education.

The partnership with Virginia Tech and the Access College Foundation is focusing on communities that generally graduate a smaller number of college-bound students.

They will be working with Booker T. Washington, Granby, Norview, and Lake Taylor high schools.

“Virginia Tech folks will be coming into the schools to provide enrichment activities,” said Karen Eley Sanders, the Associate Vice Provost for College Access at Tech. “We will be working with teachers to enhance their academic curriculum."

|

National & Federal Education News

|

How to make a good teacher

The Economist

June 11, 2016

FORGET smart uniforms and small classes. The secret to stellar grades and thriving students is teachers. One American study found that in a single year’s teaching the top 10% of teachers impart three times as much learning to their pupils as the worst 10% do. Another suggests that, if black pupils were taught by the best quarter of teachers, the gap between their achievement and that of white pupils would disappear.

But efforts to ensure that every teacher can teach are hobbled by the tenacious myth that good teachers are born, not made. Classroom heroes like Robin Williams in “Dead Poets Society” or Michelle Pfeiffer in “Dangerous Minds” are endowed with exceptional, innate inspirational powers. Government policies, which often start from the same assumption, seek to raise teaching standards by attracting high-flying graduates to join the profession and prodding bad teachers to leave. Teachers’ unions, meanwhile, insist that if only their members were set free from central diktat, excellence would follow.

Making the Grade

A 50-State Analysis of School Accountability Systems

Making the Grade

A 50-State Analysis of School Accountability Systems

Center for American Progress

May 19, 2016

Part of a Series on Implementation of the Every Student Succeeds Act

One of the most enduring and contentious debates in education circles concerns the best way to hold schools and districts accountable for improving outcomes for students and closing achievement gaps. Lawmakers, teachers, district administrators, parents, and other stakeholders—all with strong and differing opinions—have wrestled for decades with questions about the appropriate role of the federal government compared with that of states and school districts in the operation of schools and the measurement of their success. Over the past 15 years, however, a national consensus slowly has emerged among the disparate parties and coalesced into a clear movement toward more sophisticated accountability systems and fewer federal mandates.

|

|

|

Are Virginia's state and local taxes regressive?

Just like every other state in the country (though to varying degrees), the short answer is yes. But before we go into more detail, another question may be important to answer - why does the first question matter for education?

One of the recent stories in the education news was the city of Philadelphia's decision to pass a "soda tax." For one take on the background, try

this story from The Guardian or check out

the archive Philly Magazine compiled of all the articles and op-eds they carried related to the debate.) As the Guardian story notes, one of the selling points for some city council members was the use of the tax to raise funds for the city's financially struggling school system. Others,

including Democratic presidential candidate Bernie Sanders, argued that the new tax would be regressive (the portion of the population with the least income pay a greater share of that income in taxes than do those with the most income.)

The "soda tax" story highlights a long running tension in funding schools in the U.S. that was highlighted in

a recent article from the Albert Shanker Institute. The vast majority of educational funding comes from state and local governments. These governments, much more than the federal government, rely on sales and property taxes to raise revenue and those types of taxes are often regressive.

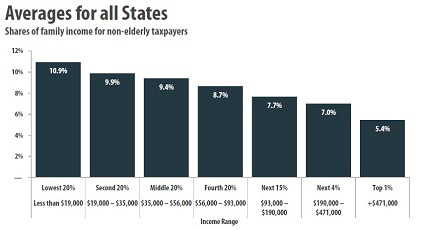

As the chart below from the

Institute for Taxation and Economic Policy (ITEP) shows, across the U.S. the average tax rate for the bottom 20% of income earners is 10.9% (combining all state and local taxes and after netting out federal tax benefits like deducations for paying state and local taxes) while it is as low as 5.4% for the top 1% of income earners. In terms of education, then, governments may be funding public schools by drawing a greater percentage of income from low-income residents than from high-income residents.

|

| From the 2015 "Who Pays?" report by the Institute for Taxation and Economic Policy |

Given the debate about the Philadelphia decision, we were curious to look at ITEP's state by state rankings of the degree to which combined state and average local taxation policy is progressive or regressive.

As you can see from the storyboard below (click on it to visit the detailed maps at our Tableau workbook) Virginia is 35th in the country (meaning 34 states have a more regressive state/local tax burden than we do.) Most regressive is Washington state followed by Florida and Texas. A key reason for this is likely the fact that none of the three have a state income tax. Most state income taxes, just like the federal income tax, are progressive (the more you earn, the higher percent of taxes you owe) and mitigate the effect of regressive sales and property taxes in states that have them.

In the first map, we've not only listed the rank of the state but also the average portion of income that a person in the bottom 20% of the income range in the state pay in taxes (in Washington state, 16.8%) and the same portion of income for the top 1% of earners (2.4% in Washington's case.

The second map looks very similar to the first, but only shows the average portion of income that a person in the bottom 20% of the income range in the state pay in taxes.

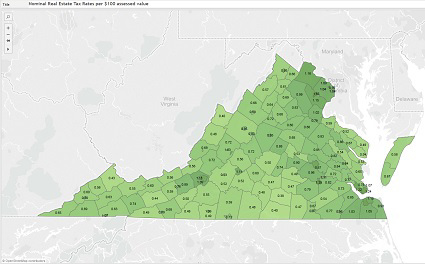

It's worth noting, however, that in developing these figures, ITEP looked at the average rate across the state. Since a state level sales tax is often a major source of state revenue, this makes sense. But we also know there is variation in what rates localities collect for local taxes. While a local sales tax is one option for some localities, the real estate tax is usually the solid base for local government revenue. So we also thought we'd map out what the nominal rates for real estate taxes are in Virginia by locality. (Again, click on it to visit the detailed maps at our Tableau workbook).

|

|

As might be expected, tax rates for cities and more urbanized counties are higher than in more rural areas where the density of services provided by local government is also less (e.g. no paid fire fighters). Of course, urban areas often have higher concentrations of poverty as well, again providing an insight into ways that those in the lower income brackets end up contributing a greater percentage of their income to state and local government services than do wealthier residents.

In this tour of tax rates, we also wanted to share with you this week's

Poll Snapshot, which looks at a public opinion question - among those willing to pay more in taxes to support schools, what type of tax do they most favor. We have not asked this question every year in our poll and so this data comes from our 2013-2014 Commonwealth Education Poll. That year 44% favored an increase in sales tax as a way of raising more revenue for schools - an option that is almost always regressive, simply because those with less income spend more of it on basic necessities.

Before we sign off, we'll also take this opportunity to wish you a happy Independence Day! Due to the holiday, Compass Point will return to your inbox on July 13th.

Sincerely,

CEPI

|

CEPI Poll Snapshot - What type of tax do people prefer for increasing revenue for education?

A short data insight from our 2013-14

Commonwealth Education Poll.

Willingness to Pay

Fifty-nine percent of Virginians in our 2013-14 poll indicated a personal willingness to pay higher taxes in order to increase school funding, while 38% say they are not willing to do so. The proportion willing to pay higher taxes for this purpose was approximately the same as the previous year.

Sixty-nine percent of those with a college degree or higher were willing to pay more in taxes for a funding increase. And those respondents under the age of 45 were most likely to be willing with 73%, compared to those who were 45-64 with 49% and over 65 with 43%. By contrast, Republicans and Independents were less likely to be willing to pay more with 49% and 50% respectively, compared to 69% of Democrats.

A plurality (44%) of those willing to pay more in taxes for a school funding increase say that a sales tax would be best; smaller proportions say an income tax (23%), real estate property tax (17%) or personal property tax (11%) would be best. These figures are similar to findings from past Commonwealth Education Polls.

(To read the full poll, visit our

website.)

|

|