Dear Subscriber:

Because you have been identified as an industry leader, you have been recommended for inclusion in an educational newsletter to share best-in-class lending industry management techniques and systems. UFA's mission is to support investors, lenders, and regulators with education and applied research to make accurate and timely predictions of risk adjusted loan profitability to create competitive advantage.

Although the future holds uncertain times, as a community we can develop strategies, best practice analytics, and tools that reduce risk and move towards more certain profit results while expanding the lending markets. |

Can You Describe Your

Worst Case Scenario? |

Whether you are a lender, investor or regulator, an important risk management exercise is to understand possible worst case scenarios. University Financial Associates (UFA) runs various simulations each quarter to help risk managers understand future default risks. A worst case scenario enables decision makers to quantify the downside risk and prepare mitigation strategies if prudent. With that information in place, decision makers can monitor the indicators (for example, house prices), determine ways to limit the worst risks, and maybe even know when they are seeing the light at the end of the tunnel.

In this issue, we focus on mortgage default rates as an example of how to apply a worst case scenario to your risk management practices. Other consumer lending products such as auto, credit card, and line of credit default rates, would see similar risks and timing relationships.

|

Are the Worst Quality-Adjusted

Vintages Behind Us Now?

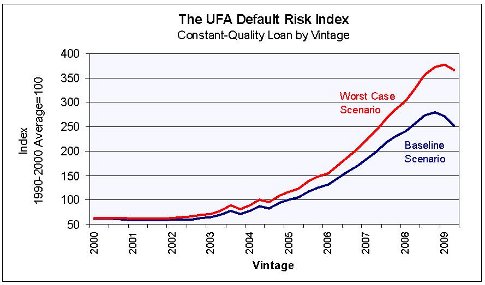

Each quarter UFA calculates its Default Risk Index, which tracks the impact of local and national monetary conditions on expected life-of-loan mortgage defaults by vintage. By holding borrower credit and loan terms constant, the Index is able to isolate the effects of local and national economic conditions from the myriad of other variables that affect loan performance. In UFA’s worst case scenario, GDP will decline 5% for two years, followed by two more years of positive 1% growth before returning to trend growth. The worst case scenario is much worse than any of the post-war recessions but far better than the 1930s.

In this worst case scenario the UFA Default Risk Index peaks at 376 in 2009 Q1, while in the baseline scenario it peaks in 2008 Q4 at 279. In a worst case, then, the Index estimates the risk of default on newly originated mortgages at nearly 4 times higher than the average of the 1990’s. By contrast the baseline scenario peaks at less than 3 times higher than the 1990’s average. The worst case is a third worse than the baseline scenario. In either case, the worst economic environment for originating mortgages is already behind us! This is an important result of the scenario experiment.

What Can We Conclude

From Our Scenario?

The Index is telling us is that the worst economic environment for mortgage loans is now in the past. The loans originated in 2008Q4 and 2009Q1 are likely to default at the highest rates after controlling for other risk factors like LTV and credit scores. Given the tools to distinguish these risks, decision makers can adjust pricing and portfolio holdings appropriately for the economic environment. Indeed it can be argued that the single biggest mistake that decision makers made in the current crisis was their failure to incorporate the rapidly changing economic environment into their decisions. Future newsletters will discuss this issue further.

|

Economic Conditions and

Loan Default Rates

|

A Turning Point

in the Cycle?

The UFA Index is a forward looking life-of-loan prediction for loans of the indicated vintage and can be contrasted with backward looking default rates on the serviced portfolio of past originations, such as the one that is compiled by the Mortgage Bankers Association.

|

Frequently, stress tests for loan portfolios miss the future local economic, product structure, and future collateral performance risks, which can be caught two to five years early with proper risk management practices. UFA creates analytical tools to help financial institutions define future default risks and account for the effects of local economic conditions on loans. To review UFA's current research, please visit http://www.ufanet.com/research1.asp.

This newsletter will be part of a community-building activity that will be driven by you and your peers. We value your comments, suggestions, stories, and questions. We promise to be responsive and considerate, and to provide relevant updates and meaningful articles. We invite you to share your thoughts by emailing newsletter@ufanet.com or directly to me.

If you wish to stop receiving this newsletter, please click the “Unsubscribe" link below, or email me directly. If you change locations, please update us with your new email address to continue receiving the newsletters. To avoid missing an issue, add this email to your "safe senders" list (for example in Outlook, right-click on the message, select "junk mail," then select "Add sender to safe list"). You can recommend associates by forwarding their name and corporate email to newsletter@ufanet.com.

Regards,

Lisa Saaf, Outreach Coordinator

UFA, LLC

lsaaf@ufanet.com

www.ufanet.com

(734) 995-7271

|

|

PRODUCT LAUNCH

| Imagine scoring local economic risks at

the zip code level, using a hassle-free pay-per-click solution. With

UFA's important innovation in mortgage and auto loan analysis, you

can.

Read More

|

CUSTOM ANALYTICAL SOLUTIONS

| Leverage UFA's decades of experience by allowing us to develop a custom analytical solution.

Contact Us

|

|