There are two main variables when it comes to loan offers:

1) Interest rate.

2) Costs paid at closing. (These include costs associated with the loan, the closing process, and prepaid expenses such as taxes and insurance.)

Between various combinations of rates, fees, and loan discount points, trying to get a clear picture of which option is best can feel like a real struggle.

For example, if one lender quotes you a 6.50% interest rate with $5,000 in closing costs, while another quotes 6.875% with $1,000 in closing costs, how do you know which loan is a better deal?

The answer depends in part on how long you intend to hold the loan, but here's a good way to address the fundamental problem.

-> Get quotes with one of the two variables held constant.

Example: Keep the interest rate constant.

Ask each lender for a quote at the same rate, i.e., 6.50%. The only other variable that will change is the amount you pay at closing. This makes it easier to see which loan is less expensive.

Tip: This method helps remove the confusion that can arise when buyers are trying to evaluate loans with and without loan discount points (more on those below).

2. Do the Math Before Paying Points

A loan discount point is paid at closing in order to lower the lifetime interest rate of the loan. (It's essentially interest paid in advance.) One point equals one percent of the loan amount and typically reduces the rate by .25 percent.

Since the lower rate results in a lower monthly payment, in order to see a net gain you need to keep the loan until the total of the monthly savings surpasses what you paid up front to lower the rate.

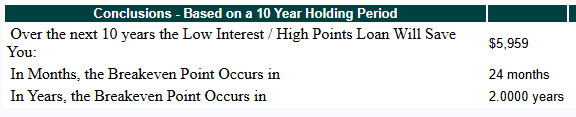

Tip: Use Mortgage Professor's Mortgage Points Calculator tool to determine whether or not it makes sense to pay points based on how long you expect to hold the loan. (Choose 'FRM' for a fixed-rate mortgage.)

You'll get a clear answer in this type of format:

Example:  (Screenshot courtesy of MortgageProfessor.com.)

(Screenshot courtesy of MortgageProfessor.com.)

3. Make Sure Quotes Don't Have Different Non-Lender or Prepaid Expenses

Non-Lender Expenses:

A full closing scenario includes estimates for costs that are not set by the lender, such as the title report and the fee charged by the closing agency.

Make sure these amounts don't vary significantly between quotes. A lender who estimates a non-lender cost inaccurately can make a loan seem more or less expensive than it really is.

Prepaid Expenses:

Part of what you pay when a home closes includes prepaid expenses. These are monthly costs such as insurance and property taxes, paid in advance and held in escrow by the lender as a buffer.

When comparing quotes from different lenders, check to see how many months of prepaid expenses they collect.

A quote that uses three months of prepaid expenses will have a much lower "cash required at closing" number than one that uses six months, but this is not a reflection of the loan cost.

Since taxes and insurance need to be paid no matter what, the higher number is simply a reflection of how many months you're paying in advance. (Any unused amount will be refunded to you when you sell the home or pay off the loan.)

Loan Approval and Credit Tips

1) Don't close unused credit cards.

Part of your credit score is based on how old your lines of credit are. Those aging cards that you may not have used for a while are probably still helping your credit score.

2) Use credit occasionally.

Lenders want to see a history of responsible credit use. While it may seem logical that not using credit at all is a sign of financial responsibility, many mortgage officers say it's a good idea to occasionally make even a small purchase and then pay it off at the first statement.

3) Think twice before parting with cash to pay off credit lines.

Buyers often assume that they should pay off all of their debt before applying for a mortgage, but if this makes them too short on cash it can actually work against them.

Lenders want to see that a buyer has cash reserves, so while paying off debt will improve a buyer's debt-to-income ratio, past a certain point it can create problems by leaving them low on the required reserves.

Nothing replaces the advice of a financial professional and it's important to run everything past a mortgage expert. These tips are meant to be a stepping stone to help you ask the right questions and compare loan options with greater clarity.