How to Decode Housing Market News

Current Headlines Usually Reflect an Older Market

Most real estate news articles base their reporting on data from closed sales. While it makes sense to do this, there are two problems that many people aren't aware of:

1) The closed sale numbers are usually at least two months old because of the time it takes to gather and publish the numbers.

2) A closed sale does not reflect the market at the time of closing - it reflects the market at the time the offer was made and accepted. This typically happens around 30 days prior to closing.

For example: A real estate article published in August is likely to use data from homes that closed in June. June closings are typically the results of buyer and seller decisions made 30 days earlier (at the time of the offer), which means that the August article reflects May market conditions.

Seasonal Trends Can Be Especially Misleading

The sales data timing gap creates even more confusion when the market is shifting.

For example, in many areas home prices trend upward during the spring. Using closed sales to evaluate a home's value in February and March often means trying to come up with a spring market price based on data from offer decisions that were made in November and December, typically two of the slowest months of the year.

The opposite effect can come into play in mid to late summer, when outdoor activities and school vacations sometimes slow things down just as headlines (based on data created in spring market conditions) are announcing that the market is red hot.

"Sales Are Down" Can Mean Many Things

News articles often state that "sales are down" (or up) with the implication that down is always bad and up always means a strong market.

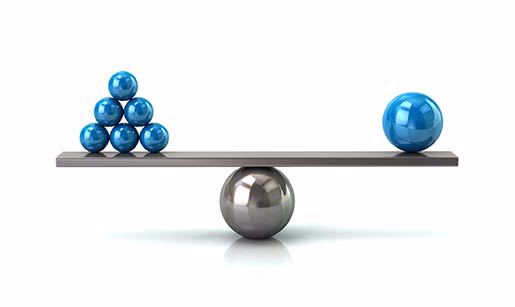

In reality, lower volume does not necessarily mean that prices are dropping. When demand is so high that homes are being snapped up quickly and inventory is decreasing, volume can drop (meaning that "sales are down") while multiple offers become more common and prices go up.

Conversely, if supply is outpacing demand in a healthy market, sales can go up even as home prices soften.

Tip 1: Be clear on whether the article is talking about sales volume, prices, or the rate of price appreciation.

Tip 2: The true sign of a weakening market is when you see longer market times and price drops on listings.

Are They Talking About Prices or Appreciation Rates?

News articles often discuss home value trends without making a clear distinction between home prices and the rate of price appreciation.

For example: If the yearly rate of home price appreciation in an area drops from 10% per year to 6% per year, a headline could correctly state that home price appreciation went down by 40%, which sounds pretty grim. However, home values would still be increasing by 6% annually.

Some States Are Experiencing Big Changes

Home value trends always vary by region in the U.S., but several areas are currently capturing the headlines with especially noticeable market shifts.

Texas and Florida, two states that have seen strong price appreciation in recent years, are being hit by a double blow of increased housing supply and enormously high insurance rates due to natural disasters.

At the opposite end of the spectrum, the Northeast and Midwest are seeing some of the biggest home value boosts - in part due to low supply, better affordability, and less exposure to extreme weather and wildfire events.

There's more regional home value information in CoreLogic's May U.S. Home Price Insights report.

Factors That Affect Interest Rates

Have you ever wondered how economic factors affect interest rates? The Mortgage Reports offers some insight in their daily rate update.

According to their information, interest rates are likely to go UP with:

- Higher 10-year Treasury note yields.

- Higher stock indexes.

- Higher oil prices.

- Lower gold prices.

- Higher Fear and Greed Index.

How to Easily Compare Mortgage Rates

One of the biggest challenges when evaluating loans is comparing apples to apples because each loan comes with its own combination of interest rate, optional loan discount points (rate buydown), and fees.

One solution is to use a website such as Bankrate.com and make the following selections when searching:

1) Choose only the loan term that you want. (Expand the "Loan term" menu to deselect any others that may be checked by default.)

2) Select "0" in the loan discount points menu. (Expand the "More filters" option to select it in the "Points" section.)

Regardless of which search tool you use, choosing one loan term and setting discount points at zero makes it easier to compare loans using the two remaining variables, interest rates and loan fees.

(Local lenders may have different rates than online sources. This method is simply a quick way to get reference points.)

While headlines may change from week to week, the best insights come consistently when you have information that helps you filter out the noise and get a clear view of the big picture.

|